Through out my financial planning career, I came across many clients where more than half of them do not have a specific financial goals. Mind blowing? Perhaps not. It is more common than you could ever imagine. All they ever wanted is just to earn more money. Sounds familiar? You might be one of them too. Well, no worry, in this post I will share with you the most common financial goal that you can set for yourself too:

Financial Independence Retire Early (FIRE)

What is FIRE?

FIRE is the short form taken from Financial Independence Retire Early.

As per the wordings, literally, it is a movement where people have the goal of gaining financial independence and retiring early. The basic idea was to having enough saved or enough passive income to cover the expenses, in order to retire early.

What does Financial Independence means?

Different people might have different interpretation. But personally, having enough without a day job.

At this point, you might think "Yeah, I want this too." I believe everyone would want this too, otherwise what is the point of working right? But a financial goal has to be measurable or quantifiable. So this is the part where my clients hire me to do all the calculations.

Yes, you need to know your number. It could be the retirement number to cover the expenses for the rest of your life post-retirement. It could also be the passive income required to cover the monthly expenses. The passive income could be coming from investment's dividend, rental income, business income and so on.

Hire me to calculate for yours too. 😉

What does Retire Early means?

Retire early could mean differently depending on the person.

Some people it could mean never having to work anymore. After working non stop for 30-40 years, 9 to 5 every weekdays, which sums up to 56,789 hours, of course it is time to enjoy retirement right! Okay I just made up the hours number, but you get what I mean.

Then of course towards some people, early retirement simply means having enough money to retire, but they continue to do so because they are passionate in their line of work. Imagine having the power to choose not having to work anymore, like you can actually fire your boss anytime if you want!

Similar to FI, you need to know your numbers. In this case, you need to know both your retirement number and retirement age. So yes, if you ask me, in a way, Retire Early is the same as Financial Independence.

Is it easy to achieve FIRE?

Achieving FIRE is not easy at all, especially on the "Early" part.

As I mentioned before, everything should be measurable. A SMART financial goal has to be time bound too. So if FIRE is one of your financial goal, then one of the question would be BY WHEN? Retire Early means before the standard retirement age of 55 or 60. So depending on your age now and also your money, I supposed you can roughly tell how easy or how difficult it would be.

Which is why you would not surprised to see some chose to work 100+ hours a week inclusive of the side jobs that they have. While some people have to do all the extreme things to save money in order to retire early. This reminds me of those TV Show like Extreme Cheapskates or Extreme Couponing. I know it could be fake but it also reminds us that not taking saving money too far.

Should You still do FIRE movement?

Whether or not it is right for you depends on what you really want and to what lengths you are willing to go to. It is NOT impossible to achieve FIRE, but you will really have to plan it out and work it out. Like the saying goes, "WHY is more important than HOW". Hence, it is utterly important to know WHY you want to do it, which can be helpful to keep you going when you feel like giving up.

Here are some of the reasons to retire early:

You want to pursue a passion that you can’t do while having a full-time job

You want to spend more time with family and friends

You want to have more time to exercise and be healthy

You want to have the freedom to choose what you want to do

You want to travel around the world

And many more, and perhaps some more common for Asian parents such as:

You need to help take care of your grandchildren 😅

Do you really know what you are going to do after retiring early?

There are a lot of disadvantages too if you are retiring early, especially without planning. Early retirement does not mean sitting around doing nothing all day. It is certainly not dozing off on a cozy sofa while the TV is watching you.

The number one con of early retirement is the declines in mental health and mobility, hence, increases in poor health outcomes, such as heart disease and stroke. Many retirees have a tough time making the transition from the daily routines of a full-time job to the unstructured life of retirement. They may find it boring and miss working, but it may not be easy to get back into the workforce once you've left it, voluntarily or otherwise.

So it is vital to decide ahead of time on what FIRE looks like for you—and how much it will cost.

Okay I know what I want, what's next? FIRE Number!

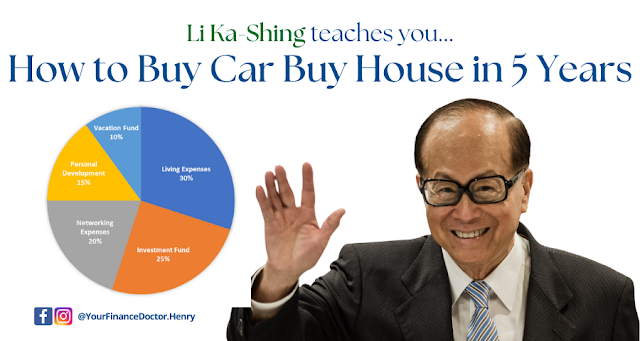

Calculations! Many FIRE movement uses simple calculation to calculate their FIRE number. Fire number can be calculated quickly but roughly. First and foremost, how much is your monthly expenses?

The monthly expenses should include utilities expenses, rental or mortgage expenses, groceries and dining out expenses, transportation expenses, household expenses, clothing expenses, healthcare expenses, entertainment expenses and whatever you see fit.

Then multiply by 12 to get your Annual Expenses which will be frequently used to calculate FIRE number regardless which rule you wanted to follow.

What is 4% Rule (FIRE Number Rule of Thumb)?

The most common FIRE number calculation where annual expenses divided by 4%.

Fire Number = Annual Expenses / 0.04

Example: RM60,000 / 0.04 = RM1,500,000

You may ask why 4%? Where do they get the magic number of 4%? This is according to Trinity Study where 3 professors of the Trinity University wrote “Retirement Savings: Choosing a Withdrawal Rate That Is Sustainable.” So the 4% rule comes from the fact that even after 30 years of withdrawing 4% of your initial portfolio, the success rate is still 95%. So with that, the 4% rule was born!

For easier calculation, 4% Rule also known as the 25x Rule. Once your net worth exceeds 25 times of your annual expenses, (25 x RM60k = RM1.5mil) in this case RM1.5mil, then congratulations you have hit FIRE!

RM1.5mil that's it, then I do not have to work anymore?

Roughly, yes. But not everyone follows this 4% Rule though. Some people go for 3% Rule or even less to be safe.

A more recent study using historical market data up to 2021 to study sustainable withdrawal rates, a 100% success rate that someone with a portfolio with at least 50% in stocks could safely withdraw 3% of their investments for 40 years without depleting their investments.

Another thing to keep in mind is that the research were done using S&P 500 Index and also US inflation data. So unless you are staying in US and investing in S&P 500 Index, otherwise it is always better to consult a licensed financial advisor to calculate. Bottom line, you can be more conservative by using lower withdrawal rate - 3% Rule, bigger FIRE Number will be needed.

What is Fat FIRE? What is Lean FIRE? What is Barista FIRE?

Trust me, there are many different types of FIRE out there. You can make one too, and if you succeed then it would become popular. But generally here are the differences:

Fat FIRE: hit FIRE with a higher annual expenses budget, spending over 100,000 annually

Lean FIRE: hit FIRE with a lower annual expenses budget, spending around 20,000 annually

Barista FIRE: hit FIRE but still with a part time job to cover long term benefits such as health insurance

Regardless which one you follow, always make sure you pick the one you are most comfortable with.

Okay, Any other rules that I should know?

Not rules but here are some methods the FIRE movement community follow to help them hit FIRE as soon as possible, such as:

Live minimally, live below your means

Save and invest first before you spend

Spend less than you make

Buy used cars only

Fully utilize credit card rewards

Focus on adding multiple streams of income

Lower your tax liability by investing in tax-deferred accounts like Private Retirement Scheme

The Bottom Line...

FIRE movement can be a great financial goal, especially if you do not have any specific financial goals yet. Having a goal like that can makes you work harder and live life to the fullest instead of just running in a endless rat race.

Start calculating your FIRE Number now! If the figure is too overwhelming, then you might look at ways to increase income or otherwise, reduce your expectation on retirement expenses. You can also talk to me by dropping a comment below or private message me in social media if you are too shy!

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)